Flax-Linen and Hemp Economic Observatory

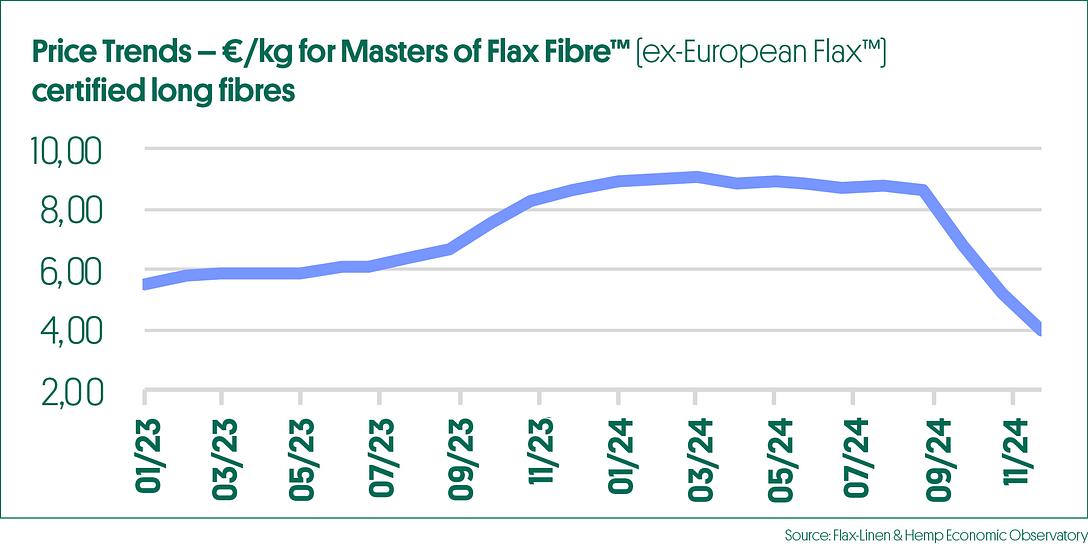

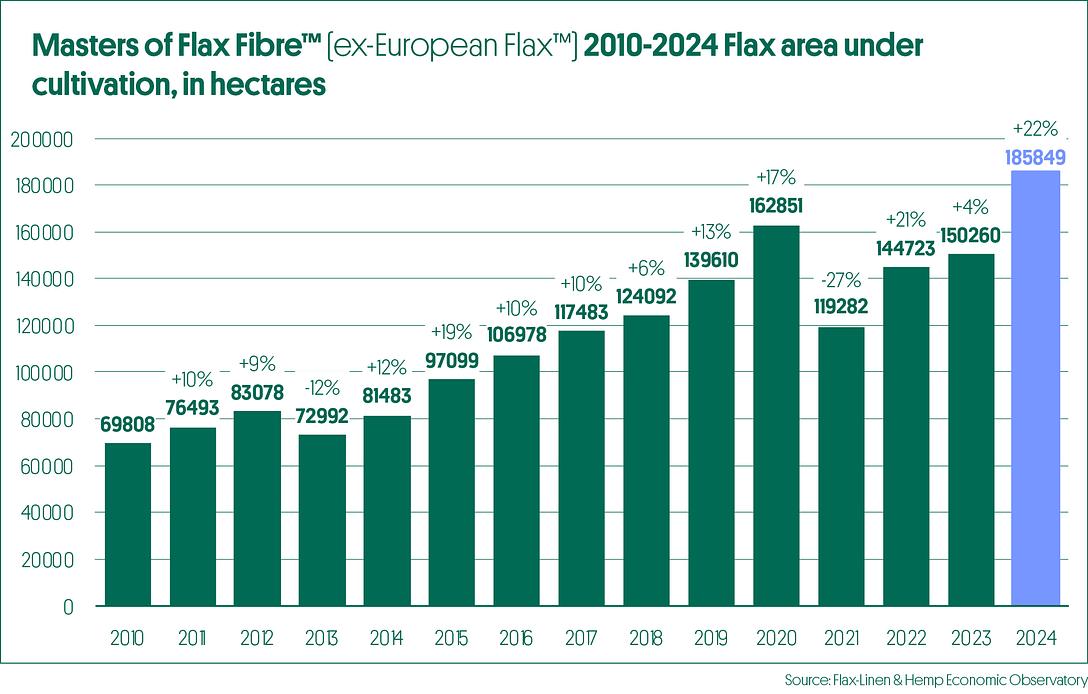

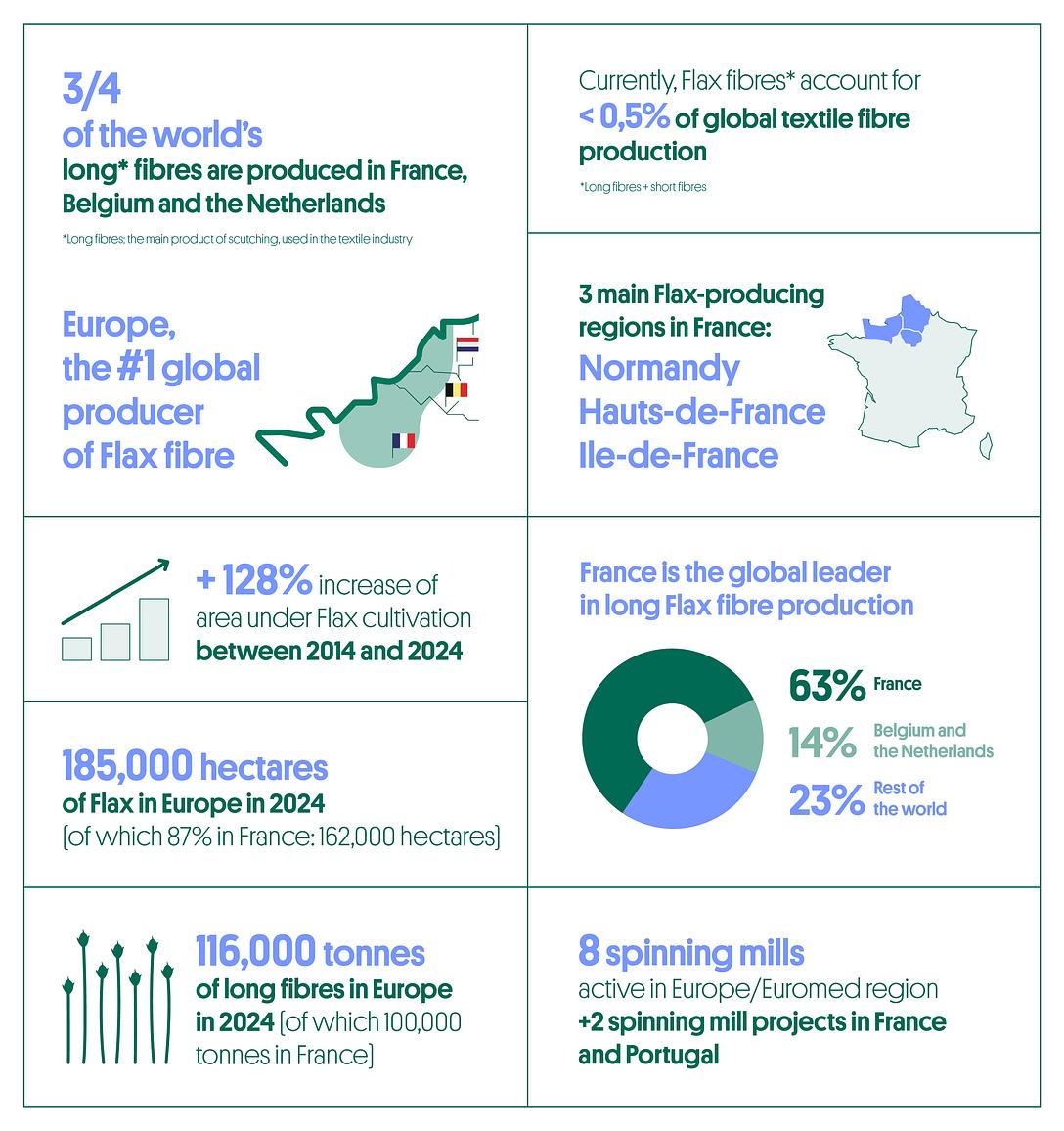

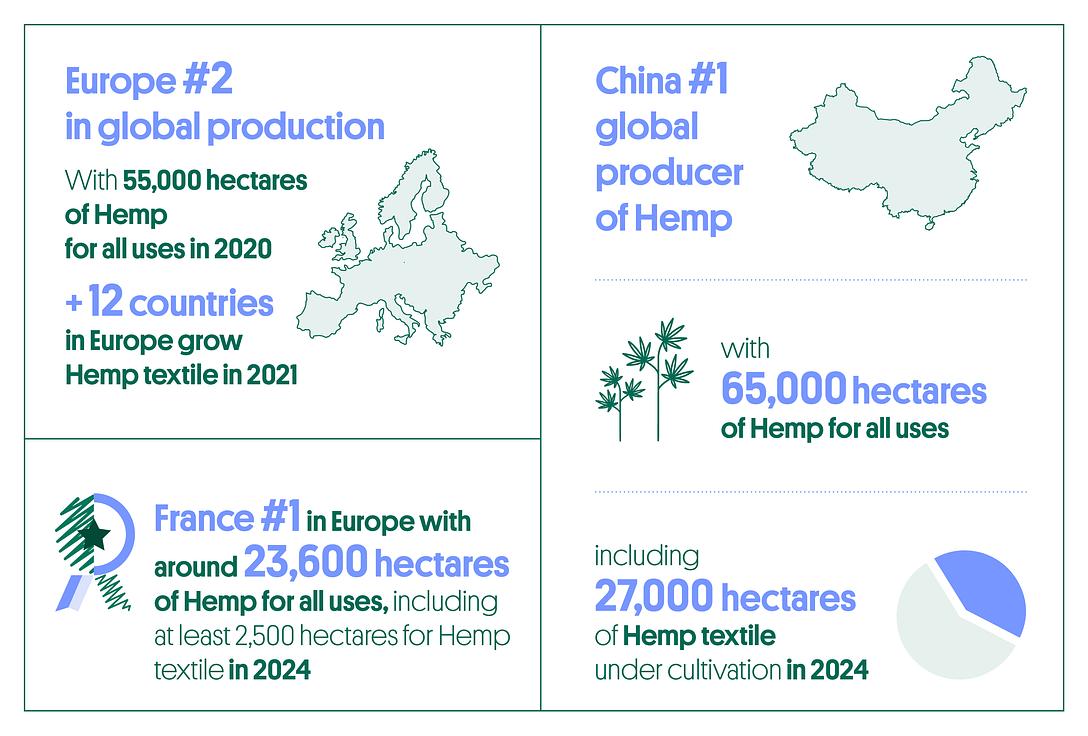

The Alliance has set up its economic observatory to collect, develop and share reliable data and information on European Flax and Hemp production. Providing decisionmaking tools: an overview of global markets, regulatory monitoring, barometer, weak signal analysis and dedicated economic studies.