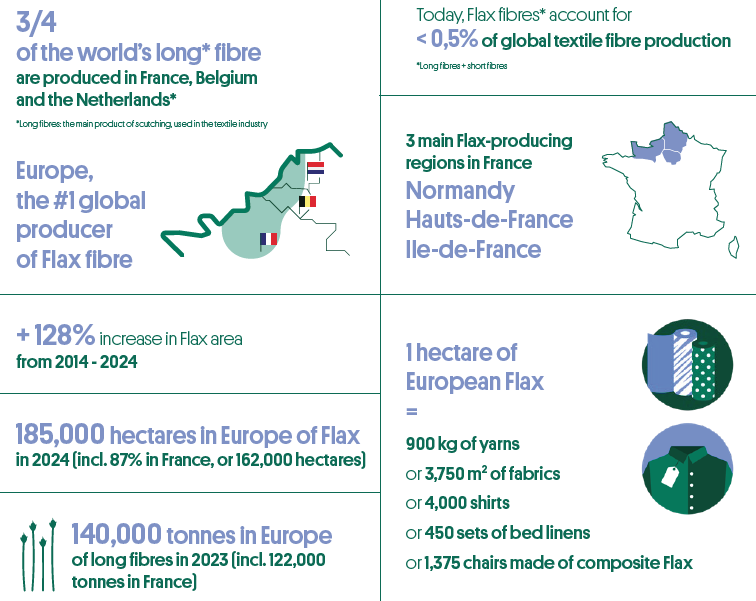

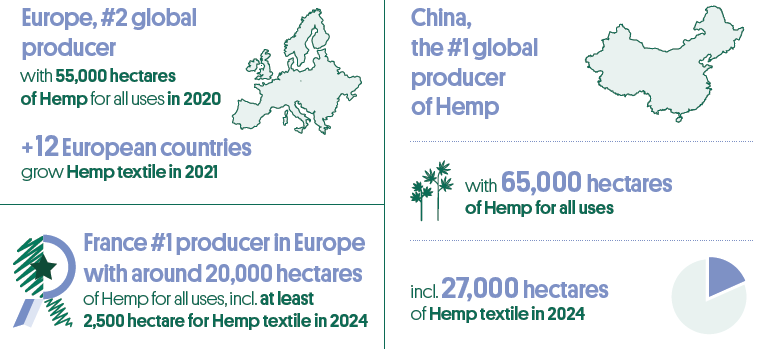

Flax-Linen and Hemp Economic Observatory - Figures 2023

Economic information on the flax fibre market and textile hemp production in 2023. Economic observatory collect, develop and share reliable data and information on European Flax and Hemp production.